Lessor Role and Types of Lessor Advantages and Disadvantages

Volvo is a counter-example, offering a white-label solution in over 28 countries, in close collaboration with a market-leading operator. Kia presents a mix of both formulas. Its captive lease business runs through Kia Lease, outsourced to a third-party lessor, but nevertheless able to pro-actively seize market opportunities. Maximum flexibility

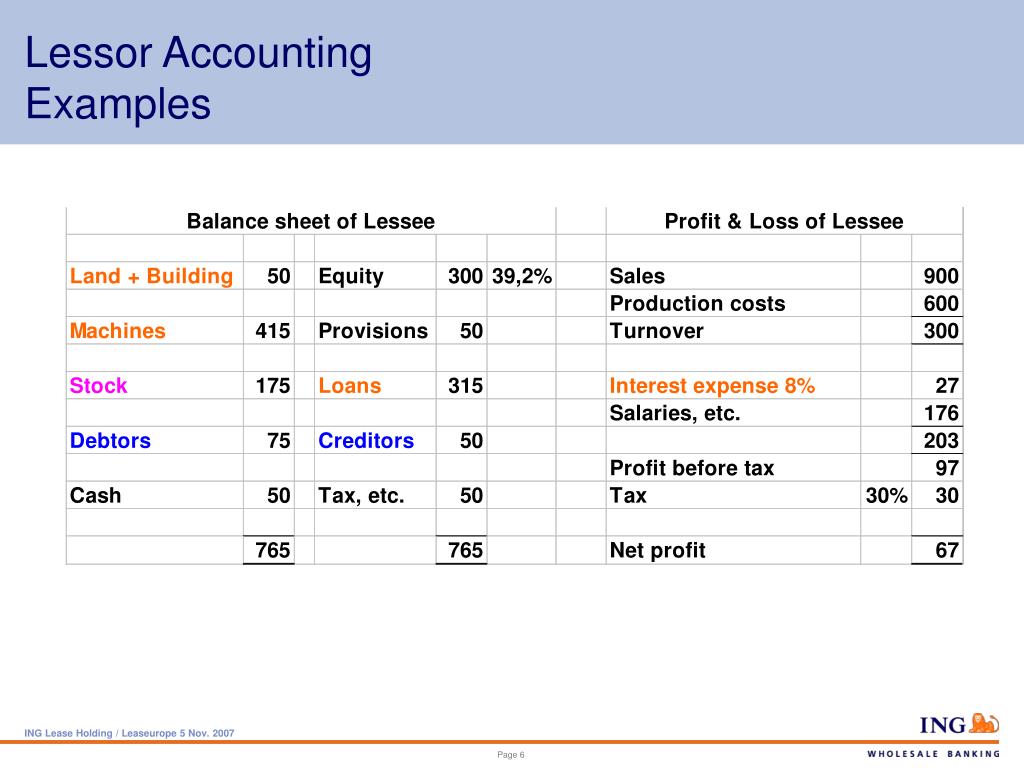

PPT Lessor Accounting Revenue Recognition and Performance Measurement PowerPoint Presentation

Captive Lessors Are An Option For Specific Brands. If you have a specific brand in mind, especially vehicles and farm equipment, you may have an additional funding option in the form of a captive lessor. In essence, these are financers owned by the equipment manufacturer to help sell their equipment.

Lessor Definition & Examples in Real Estate

The main purpose of a captive lessor is to support the top-line revenue growth and profit of the parent company, usually known as the Original Equipment Manufacturer (OEM). Captives only provide.

Lessor Vs Lessee Template 06

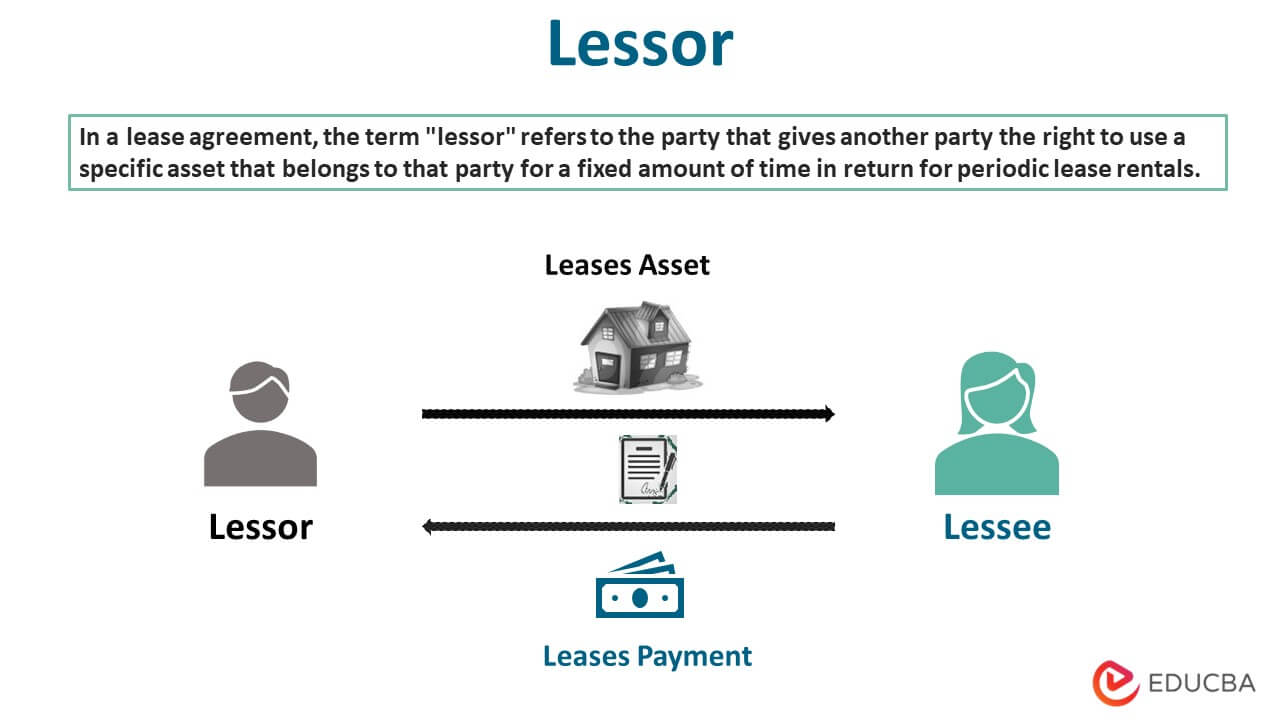

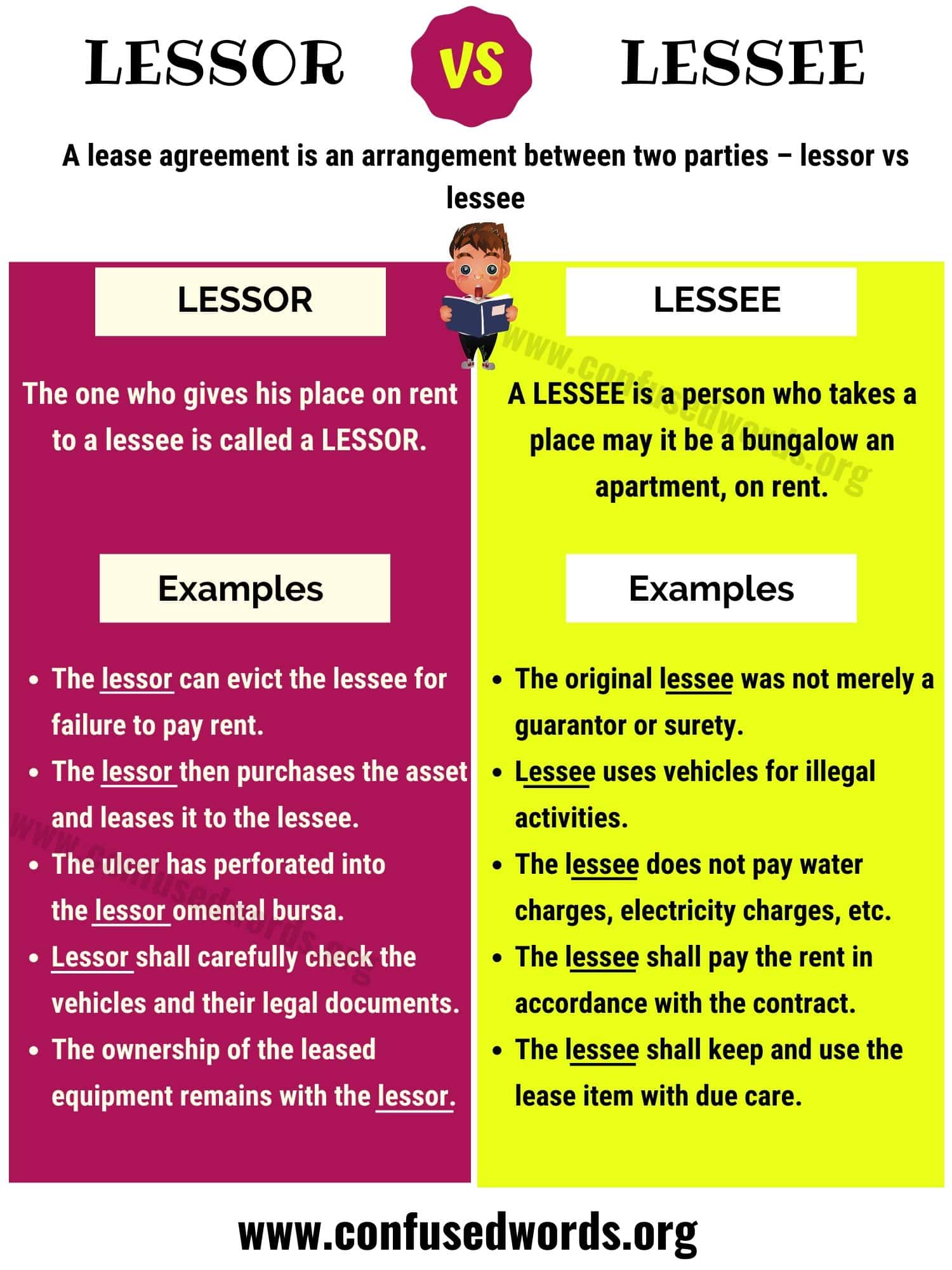

The lessor retains ownership of the asset but allows the lessee to use it in return for regular payments. Types of Lessors: There are typically three types of lessors: independent lessors, captive lessors, and dealer or broker lessors. Independent lessors are not affiliated with any particular manufacturer, and lease a wide variety of equipment.

Lease accounting differs depending on the end user. A lessor is the owner of the asset and a

Captive Leasing Companies are connected and provided directly by the sales representative selling the equipment. It is typical that a "monthly lease payment" that is attractive is provided to the.

Lessor Vs Lessee Definition Difference Example

The Age of Leasing. 16 January 2023. 34 min read. The aircraft leasing industry demonstrated its incredible resilience last year by seeming to shrug off the worst disaster in its history when the Russian war in Ukraine effectively trapped 550 aircraft in the country. Although the Russian market is relatively small in terms of global air traffic.

LESSOR vs LESSEE Difference between Lessee vs Lessor with Useful Examples Confused Words

Is a captive lessor impartial? Many vendor lessors, be it in-house or third party, will give preferential treatment to their equipment partners when the lease is over and the time to upgrade has come. Their flexibility and impartiality ends if a lessor decides to change equipment vendors at lease maturity. Additionally, a captive lessor's.

Lessor Role and Types of Lessor Advantages and Disadvantages

A captive lessor is a division, subsidiary or joint venture established with a leasing company by a manufacturer or dealer with the primary purpose of providing the lease financing of the sale of the sponsor 's products to its customers. The financial-support facilities commonly provided by captive finance companies include inventory financing to their sponsor for new and used equipment and.

Lessor vs. Lessee Top 6 Differences, Pros & Cons Difference 101

Lessor: A lessor, in its simplest expression, is someone who grants a lease. As such, a lessor is the owner of an asset that is leased under an agreement to a lessee. The lessee makes a one-time.

LESSOR vs LESSEE Difference between Lessee vs Lessor with Useful Examples Confused Words

Another approach is for the captive to use a third-party vendor lessor to buy its leases, allowing for the gain on sale to be reported up front. To maintain the relationship with the end-user customer, the arrangement can involve the captive to remain as servicer and manager of end-of-lease dispositions for a fee and share of profits.

IAS 17 7 (A) Lessee vs Lessor YouTube

Corollary: Captive lessors are willing to provide leases to lower credit quality lessees. Captives are in the unique position of having access to a known customer database of potential lessees (Petersen and Rajan, 1997). Captive lessors are also more sales- and customer-driven, while Non-Captives are more credit-driven. And because Captives are

Lessor vs. Lessee Top 6 Differences, Pros & Cons Digital bank, Finance bank, Finance

A financial institution predominantly engaged in the business of originating and underwriting lease transactions is a leasing company . Leasing companies come in the form of bank lessors, captive lessors and independent lessors and in all sizes - from small local rental stores to huge international finance companies and, together with lease.

Lessor Vs Lessee Template 01

AirAsia uses its captive lessor, Asia Aviation Capital (AAC asset portfolio was sold to BBAM and affiliates in a structured transaction for $1.18 billion) while Transportation Partners has the.

Captive 1.5 Perfectly Wrong hachette.fr

Some lessors may not require financials or a business plan for applications on dollar amounts ranging from $10,000 to $100,000.. Also known as a captive lessor, a leasing company's sole aim.

Lessor vs Lessee What You Need to Know About How Leases Work

Between captive lessors, capital leases, equipment financing agreements, and references to Section 179, the terminology can get pretty opaque.. you reimburse the lessor for the loss. Some lessors will even give you the option of selling the vehicle instead to a third party of your choice. So if it sells for $12,000, the lessor will owe you.

Captive T.1 par Sarah Rivens Littérature Roman Polar/Suspense Leslibraires.ca

Captive lessors lack a crucial backstop against financial stress that real banks can rely on in a crisis: demand deposits. "Banks can always raise funds this way," says Benmelech. "If investors are pulling money out of mutual funds and the stock market, they have to park the money somewhere, and instead of putting it in their mattress.