Ready Credit Citibank newstempo

Citi Mobile App. Get a 360° view of your finances, along with personalized spending and savings insights - at your fingertips. It's the easy way to manage your money and your accounts on the go. Or text 'APP17' to 692484 for a link to download the app.

Citi Ready Credit 3.99 p.a. for 3 Years on Initial Balance Transferred to Your Account, 199

With Citibank Ready Credit, you have access to extra cash anytime for your emergency or liquidity needs. Flexible line of credit up to 4X your monthly income or up to 8X your monthly income if your annual income is S$120,000 and above. Subject to Bank's approval+. Attractive interest rates with flexibility to change your Citibank Ready Credit.

บัตรกดเงินสด Citibank Ready Credit ให้ความสะดวกสบายเด่น ๆ อะไรบ้าง? marketsavvy.co

Compare Credit Cards

citibank ready credit บัตรเครดิตที่มีระยะเวลาผ่อนนาน และใช้เอกสารการสมัครน้อย

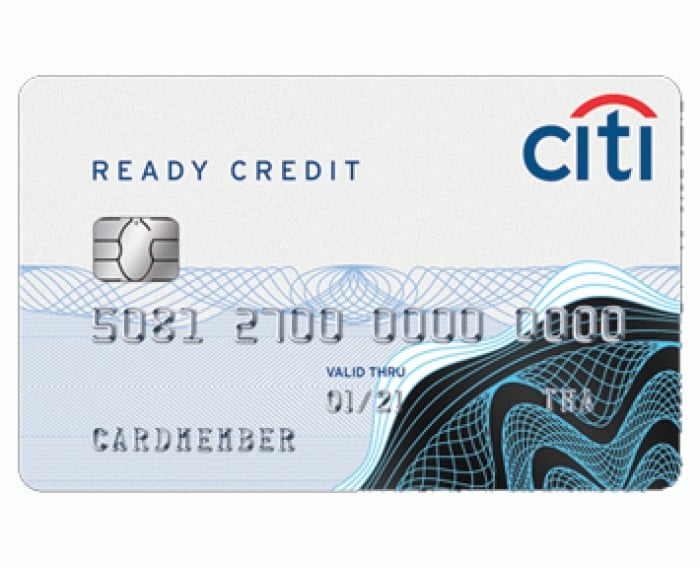

Daily spending limit of S$2,000 (applicable to retail Point-of-Sale transactions), for Citibank Ready Credit Cards issued on and after. 7 December 2014. You may revise the limit anytime, please visit us here. Double Swiping: The magnetic stripe on your credit or debit card contains sensitive payment card data.

Credit Line Increase Citi Ready Credit Citibank Thailand

Citi Ready Credit is a line of credit that can help your travel dreams come true. Go ahead and spend on any big purchases or use it to pay off an existing balance elsewhere. Enjoy a rate of 8.9% p.a. for 5 years on the initial balance you request to be transferred to your bank account. 2. Earn 70,000 Qantas Points when you request a balance to.

บัตร Citi Ready Credit เหมาะกับคุณไหม รู้ดี money

Issuance of Citibank Ready Credit Line facility is at the sole discretion of the bank and subject to its internal credit processing criteria. Rs. 5 Lakh is the maximum amount that can be extended under the Ready Credit facility. The final amount and interest rate applicable will be subject to eligibility as per Citibank's credit criteria.

รีวิวบัตรกดเงินสด Citibank Ready Credit [ วงเงินสูงสุด 1,000,000 บาท ] พร้อมวิธีสมัครบัตรด้วยมือ

Open a Citi banking account online and tap into Citi's enhanced banking solutions for checking, saving, and CD accounts.

Citibank Ready Credit

This is a great fit if you want to establish your credit. Make everyday purchases and pay your bill on time. With a secured credit card, once you are approved, you'll provide a security deposit, between $200 - $2,500. The credit limit on your new secured credit card will equal the amount of your security deposit. 2.

ซิตี้ เรดดี้เครดิต (Citi Ready Credit) ข้อมูลบัตรกดเงินสดและบัตรเครดิตของทุกสถาบันการเงินไทย

Receipt of this Agreement does not constitute approval of your Account. In this Agreement, the words "you", "your", and "yours" mean each person who applied for this Ready Credit Account ("Account"), both individually and (when there is more than one applicant) jointly. The words "we", "us", "our" and "Citibank.

Citibank Ready Credit vs HSBC Personal Line of Credit Which Credit Line is Right for You?

Citi Ready Credit is a line of credit with a predetermined limit that gives you access to funds when you need them. Now it could be even more rewarding with 70,000 Qantas Points* available when you apply by 27 September 2023, and request a balance of $5,000 or more to be transferred to your bank account within three months of approval.

บัตรกดเงินสด Citibank Ready Credit ให้ความสะดวกสบายเด่น ๆ อะไรบ้าง? marketsavvy.co

1. Alliant Credit Union. The first "bank" on this list is actually a credit union. Many credit unions do not charge overdraft fees, and Alliant Credit Union is a prominent online credit union that.

Citibank Singapore

Citibank, popularly called Citi, is a subsidiary of Citigroup Inc. and one of the largest banks in the United States, with about 65,000 ATMs to keep your funds close. While it lacks money market.

Citi Ready Credit Line of Credit Citi Australia Ad Bigdatr

รับเงินสดทันทีภายใน 1 วันทำการและผ่อนชำระด้วย Citi Ready Credit สมัครบัตรเงินสดจากซิตี้แบงก์พร้อมรับอัตราดอกเบี้ยต่ำสุดวันนี้!

แนะนำ บัตรกดเงินสด citibank ready credit เงินสดสั่งได้ โอนภายใน 1 วันทำการ Thaiger ข่าวไทย

A Citibank Ready Credit provides you with a revolving credit line. You can withdraw the loan from the credit line anytime you wish; there is no fixed monthly repayment amount or repayment period. You can choose to repay only the minimum balance as stated on the statement or the full outstanding balance. Interest will only be charged on the.

บัตร Citi Ready Credit บัตรกดเงินสดยืน 1 ที่ให้สิทธิประโยชน์คุ้มๆ มากกว่าการกดเงิน

New Citibank customers who apply for the Citibank Ready Credit account with a minimum loan amount of S$500 can also look forward to a welcome offer of 0% p.a. interest for 6 months with a 1.58%.

บัตร Citi Ready Credit บัตรกดเงินสดยืน 1 ที่ให้สิทธิประโยชน์คุ้มๆ มากกว่าการกดเงิน

Ready Credit account features. Ready Credit. Ready Credit features. With Ready Credit you have the freedom of enjoying what life has to offer, with cash ready when you are. Your account is a revolving line of credit, which means you can use and reuse your available credit for any purpose, at the Annual Percentage Rate, at any time 1.