What is Dormant Account How to Activate Dormant Account Reactivate Dormant Account YouTube

A dormant account refers to an account that has shown no activities - such as deposits and withdrawals - for a long period of time. Financial institutions need to make attempts to contact the owners of dormant accounts. If a dormant account has been unclaimed for a certain period of time, the resources held in that account must be.

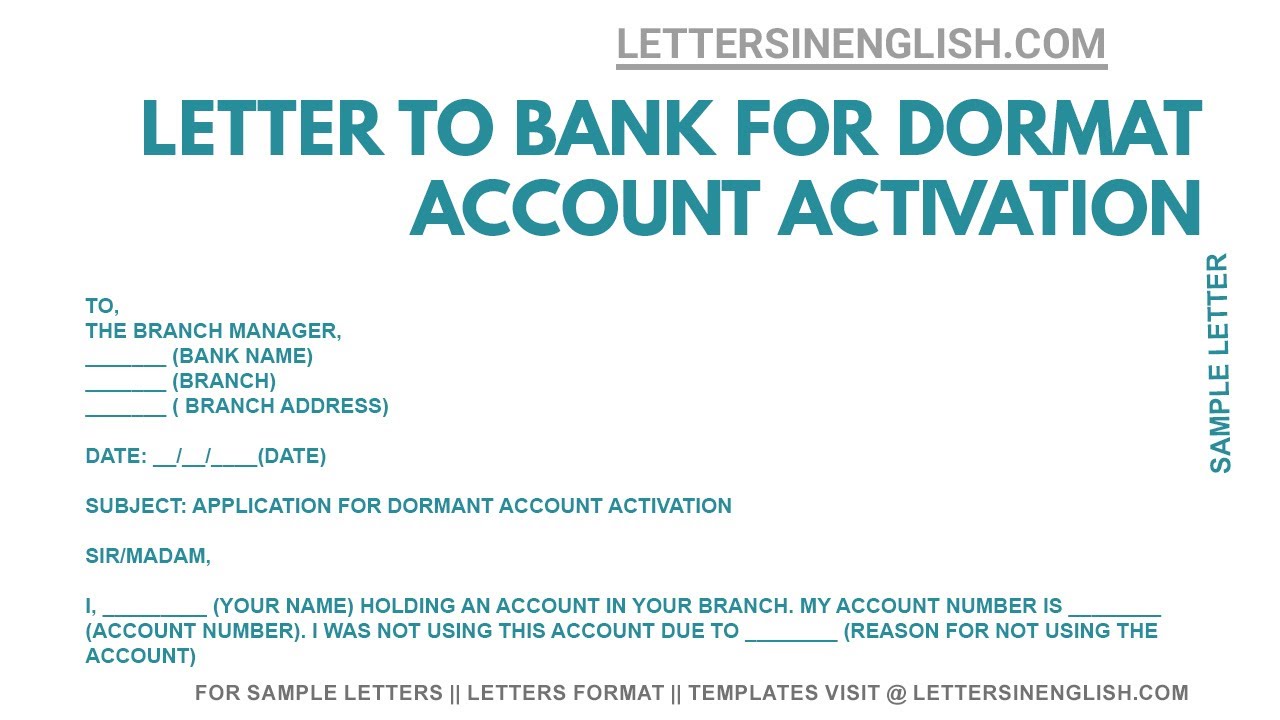

Dormant Account Activation Application Dormant Account Activation Letter Format YouTube

A dormant account, in financial terms, refers to an account that has shown little to no activity over an extended period. Typically, this inactivity occurs in the absence of transactions, deposits, or withdrawals for a specific duration. Identifying dormant accounts is a crucial first step in unlocking their untapped potential.

Dormant Accounts FAQ’s ASIA DORMANT FUND & SUPERVISION AGENCY

aktif) adalah akaun yang tidak mempunyai transaksi (deposit atau pengeluaran tidak termasuk caj yang dikenakan atau faedah yang dikreditkan) untuk tempoh berterusan selama sekurang-kurangnya 12 bulan. 2. What accounts will become Dormant? Savings Account will be deemed as "Dormant" if the account has no transaction for a continuous period.

Notice of Dormant Accounts held by Jomoro Rural Bank Limited Jomoro Rural Bank Limited

Dormant Account: A dormant account has had no activity for a long period of time, other than posting interest. A statute of limitations usually does not apply to dormant accounts, meaning that.

What is Dormant Account How to activate why bank account turned to dormancy YouTube

A dormant account is any financial account that isn't used for a set period of time. The exact time frame varies by state. Bank, investment, and retirement accounts are examples of accounts that could become dormant. Financial institutions are legally required to escheat, or transfer, funds in a dormant account to the state after a set period.

What is Dormant/ Inoperative Account? And How to Activate it? To Aid U

A dormant account is any bank account that has not sent or received a transaction in a fixed period of time. Importantly, each bank has different timelines for determining when a bank becomes dormant. However, most banks require a transaction every six to twelve months. Though the best practice is to send or receive a transaction at least.

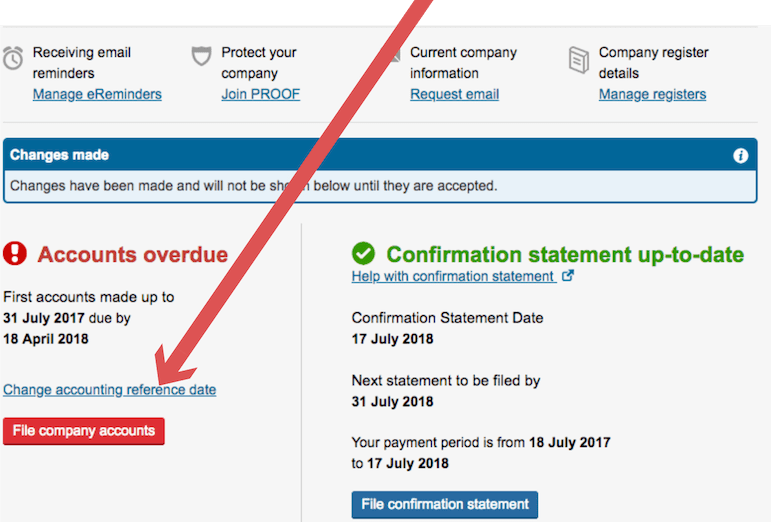

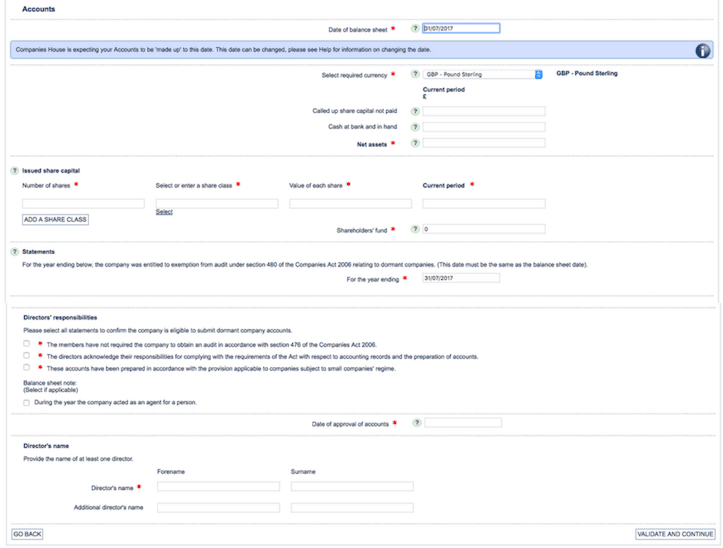

How to File Dormant Company Accounts Online Guide [2019 Edition]

Here is the process to get your money back: 1. Search a public database such as Unclaimed.org or MissingMoney.com to link to your state's unclaimed funds. The search should be free of charge. Don't put your trust in fraudster sites that charge any fee at all, even $1 for a "trial search period.". 2.

DORMANT ACCOUNTS HELD BY AGRICULTURAL DEVELOPMENT BANK LIMITED (ADB) Agricultural Development Bank

Biaya rekening dormant adalah biaya yang dikenakan atau ditanggung pemohon untuk aktivasi rekening. Besarannya berbeda-beda di setiap bank. Itulah penjelasan lengkap mengenai pengertian rekening dormant hingga cara mengatasinya. Rekening dormant adalah kondisi rekening tidak aktif karena tidak ditemukannya aktivitas dalam jangka waktu lama.

How to File Dormant Company Accounts Online Guide [2019 Edition]

Pengertian rekening Dormant secara bahasa. Dormant dalam artian bahasa di ambil dari kata dormant acoount atau akun Dormat yang artinya pasif. Dengan kata lain tidak aktif. Ini adalah pengertian yang digunakan dalam dunia perbankan. So jika anda mendengar kata rekening dormant, maka bisa diartikan rekening pasif atau sudah tidak aktif.

What you need to know about dormant bank account Snapped and Scribbled

Berikut ini adalah pengertian "Dormant Account" yang terdapat dalam Bank, Akuntansi, dsb. Artinya dijelaskan secara umum yang terkadang maksudnya tidak terlalu terikat dengan topik utama yang bersangkutan (kecuali istilahnya memang khas pada bidang/subjek bisnis tertentu).

Aspects of Dormant Account How to Reactivate Khatabook

Usually, the longer an account has been dormant, the higher the annual service fees that are charged. Banks resort to dormancy to try and prevent potentially fraudulent activities, including identity theft. For example, when companies move premises, bank statements may be delivered to an outdated address. As a result, privacy may be breached as.

What is Dormant Account How to Active Dormant or Inoperative Account YouTube

The average monthly maintenance fee in 2021 was $10.99, according to MyBankTracker.com., though it can be as high as $25. Some banks lower their fees when an account is deemed inactive or dormant. But most checking accounts don't accumulate much interest, so fees could severely eat into a low-balance account.

What is Dormant Account ? How to Reactivate Dormant Account Dormant Account Activation YouTube

Here is an overview of how a dormant account typically works: Period of Inactivity: After a specific period of inactivity, as determined by the institution, the account is flagged as dormant. This flag indicates that the account requires further action to either reactivate or close it. Account Review: The bank will review the account to ensure.

What is Dormant Account? Accounting Education

Rekening dormant terjadi karena beberapa faktor, yaitu: 1. Terjadi salah transfer. Salah transfer bisa menjadi penyebab dari terjadinya rekening dormant. Kendati begitu, tidak semua salah transfer menyebabkan rekening dormant. Salah transfer yang menyebabkan terjadinya rekening dormant bisa terjadi dengan situasi bila perusahaan A ingin.

What is dormant and inactive bank account !! Advantage and disadvantages of dormant bank account

2. Automate your savings. An account can't go dormant if it's getting transactions on a regular basis. If you're putting even a small amount, like $5, into an account every month, it'll never go dormant. You'll always have access to it, and the rate of growth might surprise you.

Dormant bank account for 10 years. What will happen? What is dormant account. YouTube

A dormant account is an account with no financial activity for an extended period, except for interest accrual. Each state has its own dormancy rules, specifying the period of inactivity required to classify an account as dormant. Dormant accounts can include various types of financial accounts, such as savings, checking, brokerage, and pension.