Spread Nedir? Forex Spread Oranları Ne Kadar?

There are two main types of spreads in forex trading: fixed spreads and variable spreads. 1. Fixed Spreads: As the name suggests, fixed spreads remain constant regardless of market conditions. This means that the difference between the bid and ask price remains the same regardless of volatility. Fixed spreads are typically offered by market.

What is Forex Spread

This is usually 1/10th of a pip, so for instance, a 3 spread would mean a spread that is 0.3 pips wide, while a 24 spread would indicate a spread that is 2.4 pips wide. You can always check to see what digits are applicable for the currency pair you wish to trade.

Forex What Is The Spread Forex Robot Geeks

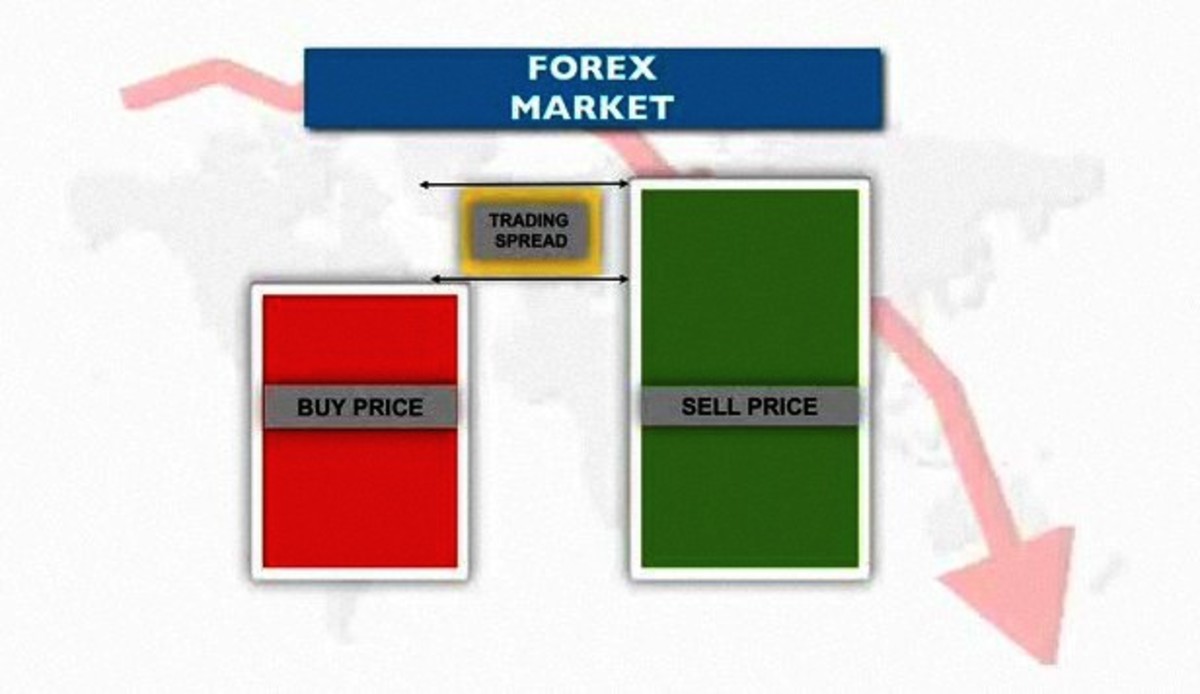

Forex Spread: An Introduction. In the Forex and other financial markets, the spread is the difference between the purchase price and the sale price of an asset. With online brokers, the purchase price is always higher than the sale price of an asset, meaning that if you opened a position and closed it straight away, you would make a loss.

Understanding Forex Spreads Forex Volume Strategies

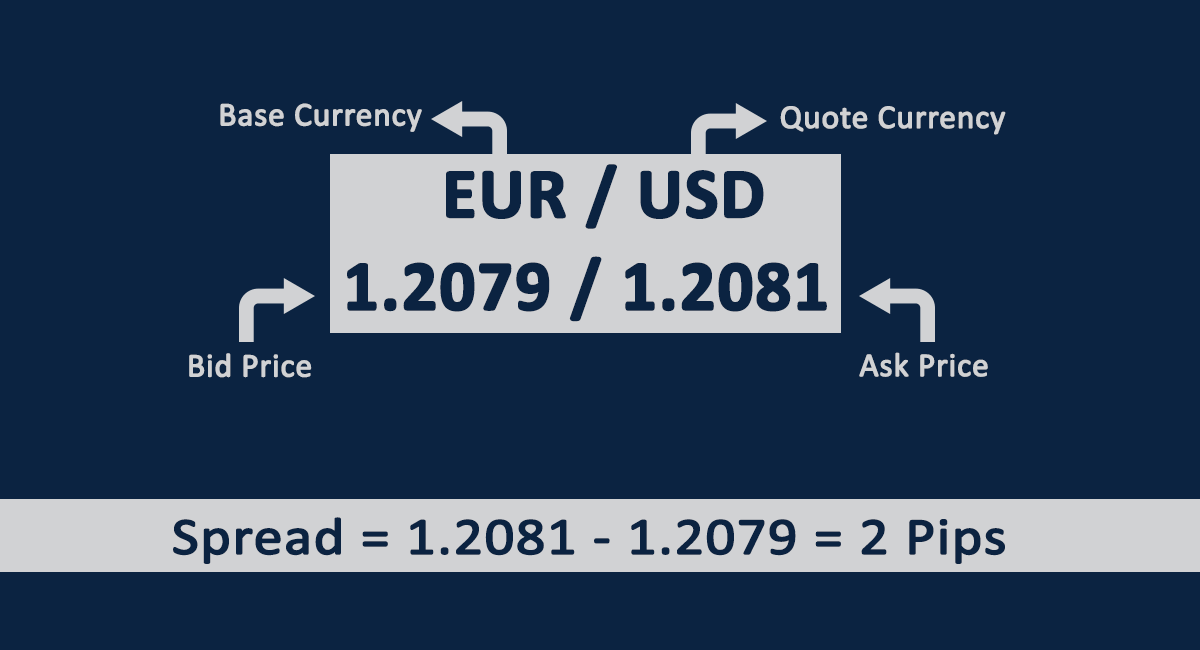

Forex brokers will quote you two different prices for a currency pair: the bid and ask price.. The "bid" is the price at which you can SELL the base currency. The "ask" is the price at which you can BUY the base currency. The difference between these two prices is known as the spread.. Also known as the "bid/ask spread". The spread is how "no commission" brokers make their money.

What Is Spread In Forex? Key Spread Trading Strategies

The tighter the spread, the better value you get as a trader. For example: The bid price is 1.26739 and the ask price is 1.26749 for the GBP/USD currency pair. If you subtract 1.26739 from 1.26749, that equals 0.0001. As the spread is based on the last large number in the price quote, it equates to a spread of 1.0. Forex spread indicators

How to Understand Forex Trading Spreads Howcast

That means as soon as our trade is open, a trader would incur 0.6 pips of spread. To find the total spread cost, we will now need to multiply this value by pip cost while considering the total.

Binary Options DX Trade C4 Nitro Forex System YouTube

In forex trading, spreads are always expressed in pips, with a pip being 1/10,000th (0.0001) of a standard "lot." A "lot" consists of 100,000 units, so for an AUDUSD trade, a pip equates to USD $10 (0.0001 x 100,000). Suppose the average spread for AUDUSD is 0.821 pips (as per IC Markets); the spread cost amounts to USD $8.21 (0.821 x $10).

What is A Forex Spread? Understanding Forex Spread BeoForex

The spread is one of the most important concepts to understand when it comes to trading Forex because it can make a significant difference to your bottom line. Most Forex brokers will make their profit via the spread. Think of the spread as the price that you pay for your Forex transaction. To further push that point, consider that if a broker.

What is a Spread in Forex? EA GROWING FOREX & GOLD (XAUUSD) TRADING

To calculate the spread in forex, you have to work out the difference between the buy and the sell price in pips. You do this by subtracting the bid price from the ask price. For example, if you're trading GBP/USD at 1.3089/1.3091, the spread is calculated as 1.3091 - 1.3089, which is 0.0002 (2 pips). Spreads can either be wide (high) or.

Forex Spread Ultimate Guide to Spread Trading LiteFinance

Key Takeaways. The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency.

En Düşük Spread Veren Forex Firmaları Forex Spread Oranları

Live Forex Spreads. Forex brokers spread comparison in real time. Best spread is colored in green, worst spread is colored in red. For overall best spreads, look for the row colored mostly with green cells. Although spreads are a major factor in choosing a broker, they do not represent execution quality, slippage, or any other fees of a broker.

Spread in Forex Explained Definition & Examples

What is a Spread in Forex? In simple terms, a spread in forex refers to the difference between the buying (ask) price and the selling (bid) price of a currency pair. It is essentially the cost of trading and is measured in pips. Pips are the smallest unit of price movement in the forex market. For example, if the EUR/USD currency pair has a bid.

O Que é Spread Forex? Como Funciona o Spread Trading (2020) Admirals

Calculating Forex Spread. Forex spread is calculated by subtracting the bid price from the ask price. The resulting value is the spread in pips. For example, if the bid price of USD/JPY is 110.50 and the ask price is 110.55, the spread is 5 pips. Spread = Ask Price - Bid Price. In the example above, the spread can be calculated as follows:

Understanding Spread in Forex What It Is and what Moves It

Historical forex spreads. Spreads are an inherent cost of trading. Rather than just viewing the minimum spread or current live spread we offer, you can use the OANDA spread tool to view minimums, averages and maximums that we have published on our trading platforms over the last few months. Create account Demo account.

O Que é Spread Forex? Como Funciona o Spread Trading (2020) Admirals

Forex spreads, the difference between the bid and ask prices, directly impact the costs associated with executing trades. As a trader, it is important to be able to accurately calculate the spread costs and interpret their implications for your trading strategies and profitability. Calculating Forex Spreads

WHAT IS THE SPREAD IN FOREX? SIMPLIFIED AND EXPLAINED YouTube

To Calculate the Spread: Spread = 1.1205 - 1.1200. Spread = 0.0005 or 5 pips. In this scenario, if you decide to enter a trade immediately, you'll start with a 5-pip deficit, which represents the broker's fee for facilitating the trade.